Return on Investment

Boost Your ROI with Our Expertise in Tax Benefits.

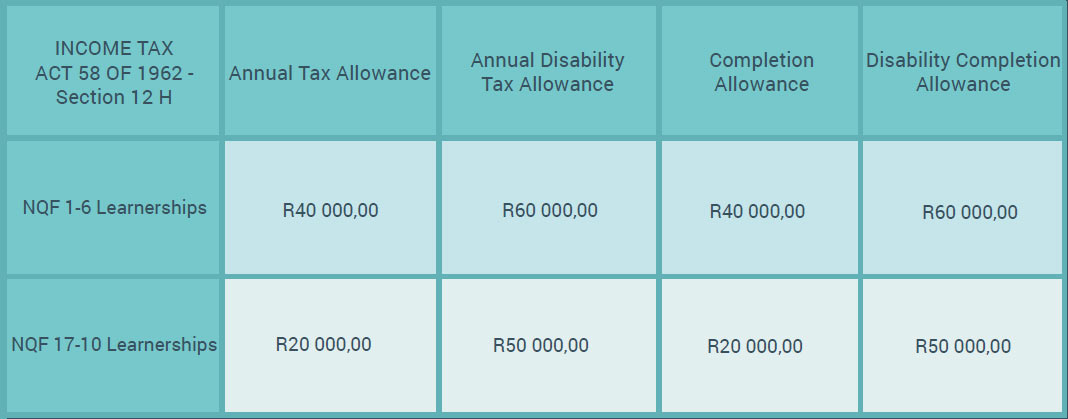

Learnership Tax Allowance

(Section 12H of Income Tax Act)

In South Africa, the Learnership Tax Allowance under Section 12H of the Income Tax Act No. 58 of 1962 provides a tax incentive for employers. This allowance, which is in addition to standard income tax deductions, is subtracted from the employer’s taxable income for the financial year. Employers who enter into registered learnership agreements with both unemployed individuals and existing employees are eligible for tax relief. If a learnership is discontinued for any reason, employers are entitled to claim a pro-rata amount of the commencement allowance.

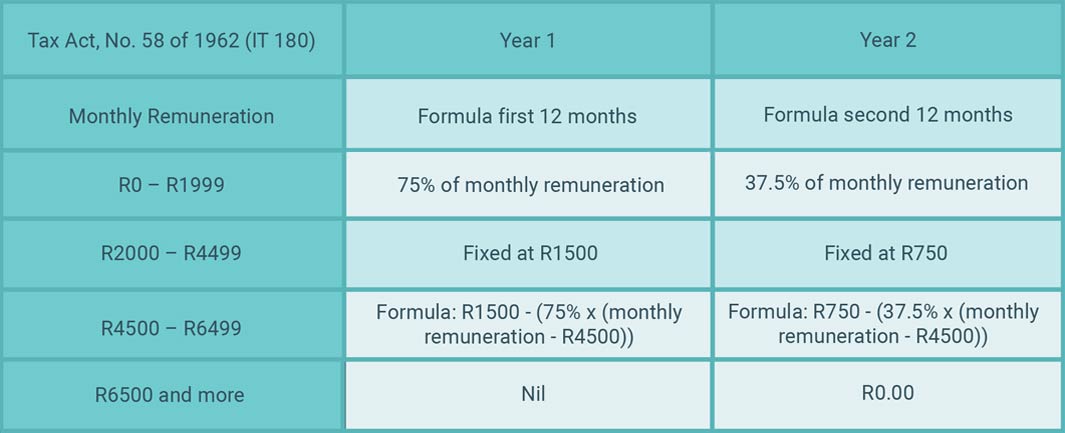

Employment Tax Incentive (ETI)

The Employment Tax Incentive (ETI) is a government initiative that helps reduce the cost burden for employers when hiring young job seekers. It operates as a cost-sharing mechanism, ensuring that the employee’s wage remains unaffected. Employers can claim the ETI to decrease their Pay-As-You-Earn (PAYE) tax liability, corresponding to the total ETI amount for all eligible employees. This incentive not only promotes the employment of young entrants into the job market but also provides financial assistance to employers.