OUR B-BBEE consulting service division is run by a diverse group of professionals to address your specific B-BBEE needs. Initiatives implemented will be carefully planed in line with your company targets.

There are numerous opportunities to offset this investment by way of approved tax rebates as well as having all the learning and skills development initiatives count towards SD accreditation for BBBEE verification.

The learnership Tax Allowance Section 12H of the Income Tax Allowance Act No.58 of 1962. The tax allowance, in addition to other income tax deductions, is deducted from the employer’s taxable income for the financial year under consideration. Tax relief is granted to employers that enter into registered learnership agreements with persons that were unemployed as well as their existing employees. Should a learnership be terminated, regardless of the reason for termination, the employer will be entitled to a pro rata portion of the commencement allowance;

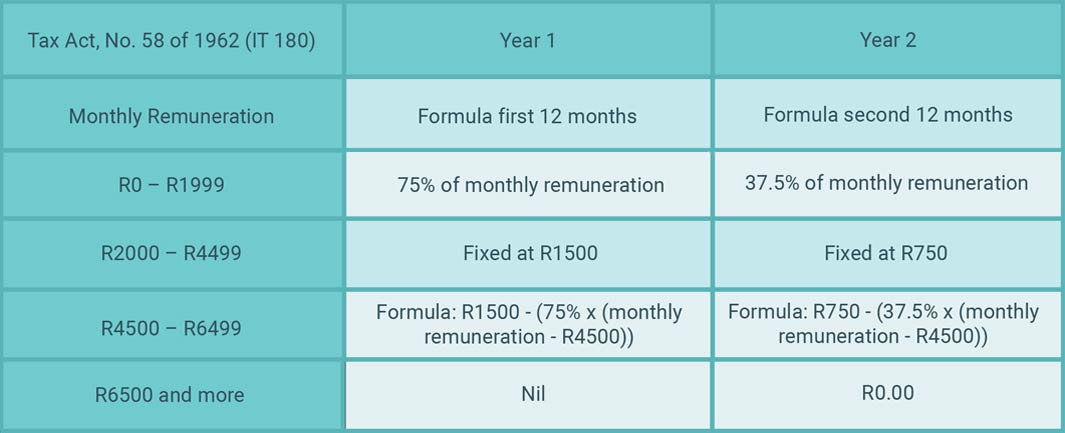

The Employment Tax Incentive reduces an employer’s cost of hiring young people through a cost-sharing mechanism with government, while leaving the wage the employee receives unaffected. The employer can claim the ETI and reduce the amount of Pay-As-You-Earn (PAYE) tax payable by the amount of the total ETI calculated in respect of all qualifying employees;